Government amends the start date of proposed small business CGT concessions measure

The government will amend the start date of their proposed small business CGT concessions measure. In amendments to the bill on 21 June 2018, the government has decided to push the start date back to 8 February 2018, the date the draft legislation was released for consultation. This will provide a transition period between announcement and the date of effect, a change that is also expected to bring welcome relief to tax advisers and their clients.

Improving the integrity of the small business CGT concessions

Public consultation closed on 28 February 2018 on exposure draft legislation which is intended to implement the 2017 Budget announcement to improve the integrity of the small business capital gains tax (CGT) concessions.

The amendments include additional basic conditions that must be satisfied for a taxpayer to apply the small business CGT concessions to a capital gain arising in relation to a share in a company or an interest in a trust (the object entity).

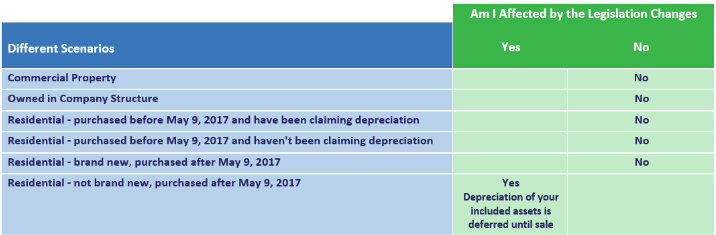

Can I still claim tax depreciation on my investment property since the new legislation passed?

Capital Claims, the tax depreciation specialists, have recently published this article Can I still claim tax depreciation on my investment property since the new legislation passed?, specifically targeted to investors to assist them with understanding the changes to the investment property property depreciation rules, the new legislation for which was passed in November 2017.

Purchasers of New Residential Properties to Remit GST at Point of Settlement

From 1 July 2018, purchasers of new residential premises and new subdivisions of residential land will be required to remit GST on the purchase price to the ATO directly on or prior to settlement.

This will replace the current GST on a quarterly or monthly basis in their Business Activity Statements, which can be months after the settlement date. This new arrangement is expected to assist in reducing the delays or failure in remitting the GST on sales for some property developers.

Withholding GST from property transactions will affect the cash-flows of property developers

The Bill containing the legislation dealing with the withholding of GST by purchasers in property transactions was introduced on 7 February 2018. There is no change to the commencement date for the new regime, which remains 1 July 2018. The Bill contains a number of important changes from the Exposure Draft.

Cash flow impacts

The new legislation, will result in the supplier receiving the consideration for the property net of an amount representing the GST. Therefore, a supplier, such as a property developer, will not receive the full consideration as they do currently, because an amount representing an estimate of the GST will have been withheld by the purchaser to be paid directly to the ATO.

Under the current rules, the property developer would have had the use of this additional cash at least until some or all of it were paid to the ATO on the next BAS. This new legislation could have significant practical implications for the cash flow of property developers, as well as a knock-on effect for them in meeting bank covenants in respect of their cash reserves.

Payroll Management

As payroll management becomes increasingly complex, requiring even greater expertise, timeliness and attention to detail, we can assist you in calculating, processing and managing…

Expatriate Services

As globalisation in the world market accelerates, an increasing number of companies are realising the need for, and the benefits of, having an internationally…