In a recent announcement by the NSW Government a new small business fees and charges rebates have been introduced to help small businesses recover from the impacts of COVID-19 and encourage growth and opportunity.

What is the small business fees and charges rebate?

The NSW Government will provide eligible business or not-for-profits with a rebate of up to $1,500 to offset eligible costs of NSW and local government fees due and paid between 1 March 2020 and 30 June 2022.

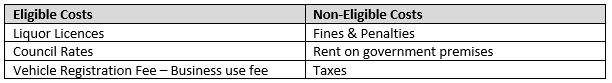

These eligible costs include, but not limited to;

Who is eligible and how to apply?

If you are a small business (including non-employing sole traders) or a not-for-profit organisation, you may be eligible for the rebate if;

• Your total Australian wages are below the NSW 2020-2021 Payroll Tax threshold of $1.2 million,

• You have an ABN registered in NSW and/or you have a business premises physical located and operating in NSW

(note: only one rebate per valid ABN),

• You are registered for GST

(note: excluding not-for-profit organisation which must meet the final eligibility point),

• You declare that your business turnover is greater than $75,000 per year

If you would like to find out more about these rebates, please contact our office.