The impact of COVID-19 (commonly referred to as the Coronavirus) on Australian businesses and the effect on financial reports.

The Coronavirus has now spread globally and is having a major impact on both the global economy and the Australian economy. Unfortunately, no one…

Walker Wayland NSW to go Carbon Neutral

Walker Wayland NSW is currently in the process of becoming completely Carbon Neutral. This is exciting news with the goal of entirely neutralising the…

Hattember 2019 is launched in style!

Thursday September 5th saw the opening of Hattember with the Hattember Gala held which included the announcement of winners in the 2019 The Hattember…

Time’s up! AASB 15, the new revenue standard is here. Are you ready?

Are your clients ready for the new revenue standard – AASB 15 Revenue from Contracts with Customers? TIME IS UP.

Time has run out to understand and assess the implications of the new accounting standard, AASB 15 Revenue from Contracts with Customers. The impact of the application of AASB 15 must not be underestimated. The International Accounting Standards Board have fundamentally changed how entities recognise revenue.

For periods commencing on or after 1 January 2018, the new revenue standard, AASB 15 will replace the various existing accounting standards and interpretations applicable to revenue recognition with a single standard based on a principles-based model.

The new standard provides a five step process to ensure an entity recognises revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled to in exchange for the goods or services.

Whilst understanding the application of AASB 15 on your clients various income streams will be complex and is fundamental, it is important to note that the impact of applying AASB15 goes far beyond revenue recognition and there are a number of wider implications that must be considered.

The new Lease Accounting Standard – Will your organisation be affected?

Most organisations in Australia undertake some form of leasing arrangement and many of these lease arrangements have been classified as operating leases with no impact to the balance sheet.

Over 85% of the leasing commitments do not appear on today’s balance sheets, making it difficult for investors and other users of financial statements to obtain an accurate picture of an entity’s future leasing commitments.

The new leases standard – AASB 16 is effective from the beginning of the 2019 calendar year. Property and equipment operating leases previously recognised off-balance sheet will be accounted for as a Right-of-Use (ROU) asset and lease liability. This will provide more transparency regarding a company’s leasing commitments and change key financial measurements such as gearing ratios, asset turnover and EBITDA. However, lessor accounting will remain unchanged from the current leases standard.

Financial Reporting Update 2018

Financial Reporting Update 2018

Asset Recoverability: SMSF Auditor fails to qualify opinion leading to losses for the trustee

“SMSF Auditor Failure to Qualify Opinion, leading to losses for Trustee’’

On 23 May 2018, the NSW Court of Appeal handed down a decision that the auditor of a self-managed super fund (SMSF caused the losses incurred by the trustee of the SMSF.

In the case Cam & Bear Pty Ltd v McGoldrick, the decision was held in the NSW Court of Appeal (NSWCA), that the Auditor of the SMSF had breached his duty of care to the trustees of the SMSF, in that negligence was displayed in the Auditors performance when issuing an unqualified audit opinion, albeit significant issues were present in the SMSF financial statements for the financial years 2003 to 2007.

This negligence ultimately resulted in the financial losses sustained by the plaintiff.

The decision by the NSW Court of Appeals resulted in a liability apportionment of 90/10 against the auditor. (See more details about the case here). The case findings provide a reminder to all audit practitioners about the requirements to comply with all relevant Australian Auditing Standards during the conduct of an audit, in particular; ASA 500 – Audit Evidence.

Asset Recoverability – “SMSF Auditor Failure to Qualify Opinion, leading to losses for Trustee’’

“SMSF Auditor Failure to Qualify Opinion, leading to losses for Trustee’’

On 23 May 2018, the NSW Court of Appeal handed down a decision that the auditor of a self-managed super fund (SMSF caused the losses incurred by the trustee of the SMSF.

In the case Cam & Bear Pty Ltd v McGoldrick, the decision was held in the NSW Court of Appeal (NSWCA), that the Auditor of the SMSF had breached his duty of care to the trustees of the SMSF, in that negligence was displayed in the Auditors performance when issuing an unqualified audit opinion, albeit significant issues were present in the SMSF financial statements for the financial years 2003 to 2007. This negligence ultimately resulted in the financial losses sustained by the plaintiff.

The decision by the NSW Court of Appeals resulted in a liability apportionment of 90/10 against the auditor. (See more details about the case here)

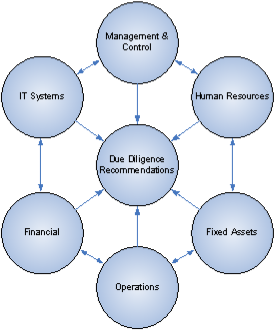

Mergers and Acquistions

The Walker Wayland Due Diligence Methodology is based on the review of six core operational business units. The basis of our methodology is that…