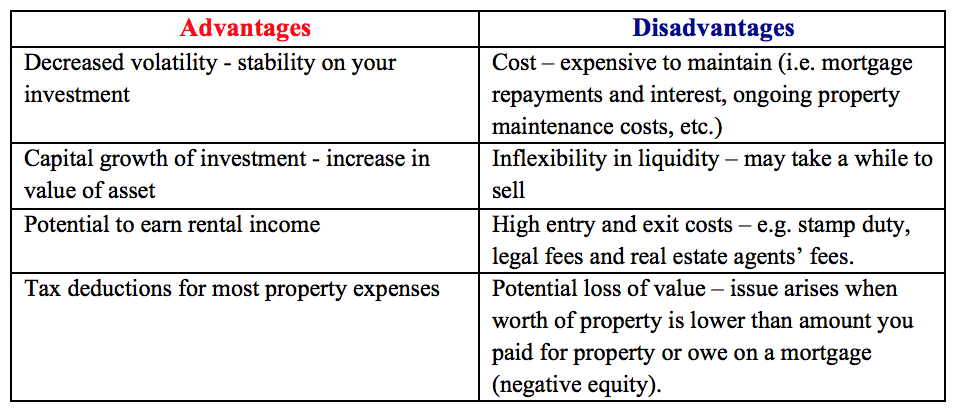

When considering whether you should invest in residential property contemplate the below simplified advantages and disadvantages:

You should always have a clear goal when making investment decisions (what do you hope to derive from this investment). Many investors opt to negatively gear their properties. This means that the property expenses and interest repayments on their loans are greater than their rental return; therefore, they are running at a loss.

In the Australian market investors can significantly reduce their tax paid through this method as the Australian Tax Office (ATO) allows for rental losses to be offset against other income (e.g. salary, business income, etc.). If your other income does not cover the full loss amount it may be carried forward into the following financial year and used then.

Investing in Australian property may seem like the only option, but it is generally recommended to achieve an effective investment portfolio and reduce risk while increasing flexibility, that investors create a diversified portfolio with investments in multiple markets and asset classes (i.e. property, shares, managed funds, etc.)

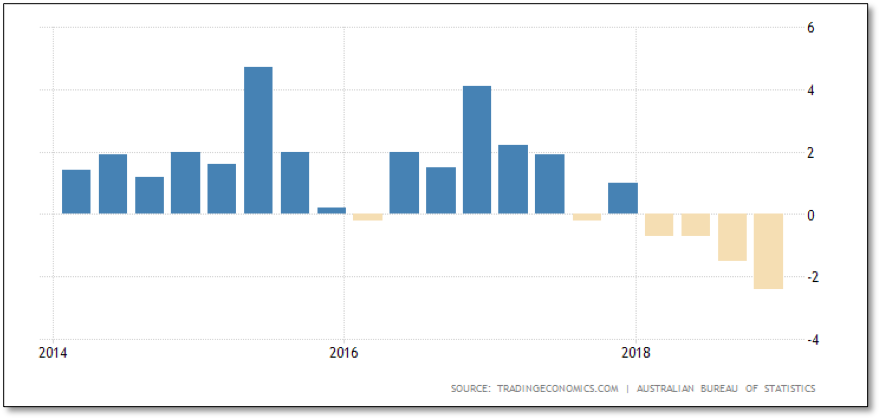

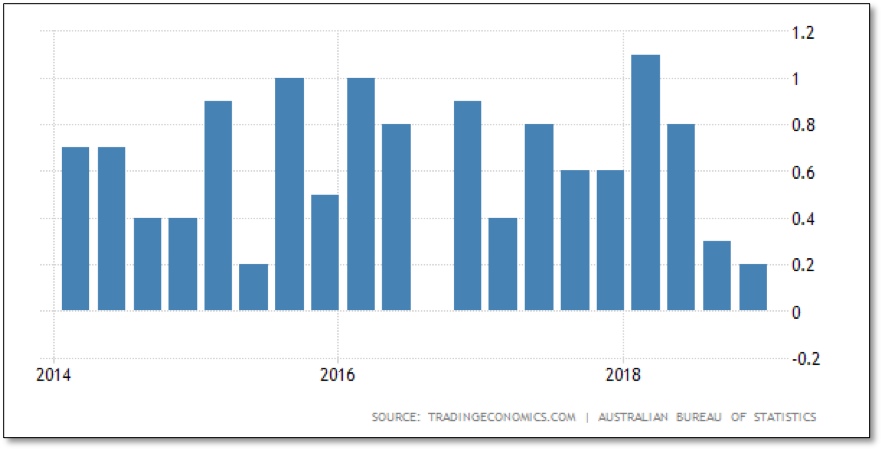

In lieu, with the continued weakening of property prices there is ongoing concern from investors in relation to whether there will be further falls through 2019. This concern can be supported by the below graphs from ‘Trading Economics’.

The Australian housing market over the last year has seen a 5.1 percent decline in property price growth; this is synonymously interrelated with Australia’s economic growth (Gross Domestic Product – GDP) seeing a decline in the December Quarter (October 2018 to December 2018) by a seasonally adjusted 2.4 percent.

Australian Housing Price Index:

source: tradingeconomics.com

Australian GDP Growth Rate:

source: tradingeconomics.com

As uncertainty grows there is a silver lining; with the recent re-election of the Coalition government, it is likely that housing policies will stay the same meaning increased or maintained stability.

Economists are predicting that the market will “bottom-out” reaching its lowest point, and from there experience steady growth. This is partly due to the Australian Prudential Regulation Authority (APRA) announcing a recommended relaxation of lending restrictions and the Reserve Bank of Australia (RBA) maintaining record low cash rates, currently at 1.5 percent.

Article by: Sylvia Van Wyk

References

• Karen, S. (2019). Property industry reacts to Liberal Party win. [online] Smartpropertyinvestment.com.au. Available at: https://www.smartpropertyinvestment.com.au/tax-and-legal/19598-property-industry-reacts-to-liberal-party-win.

• Lowe, P. (2019). Statement by Philip Lowe, Governor: Monetary Policy Decision | Media Releases. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/media-releases/2019/mr-19-11.html.

• Martin, L. (2019). Housing market may bottom out over next year, Australian property experts say. [online] The Guardian. Available at: https://www.theguardian.com/australia-news/2019/may/22/housing-market-may-bottom-out-over-next-year-australian-property-experts-say.

• Murphey, J. (2019). What election results really mean for the property market. [online] News.Com.Au. Available at: https://www.news.com.au/finance/economy/australian-economy/what-election-results-really-mean-for-property-market/news-story/99b8b40c1541f4325c4c847e79990933.

• Sas, N. (2019). Sydney property prices to rise by end of 2019, analysts predict. [online] ABC News. Available at: https://www.abc.net.au/news/2019-05-22/sydney-property-market-to-bottom-and-turn-as-confidence-returns/11137166.

• Unknown (2019). Australia GDP Growth Rate | 2019 | Data | Chart | Calendar | Forecast | News. [online] Tradingeconomics.com. Available at: https://tradingeconomics.com/australia/gdp-growth.

• Unknown (2019). Australia House Price Index | 2019 | Data | Chart | Calendar | Forecast. [online] Tradingeconomics.com. Available at: https://tradingeconomics.com/australia/housing-index.

• Unknown (2019). Property – Expenses you can claim. [online] Ato.gov.au. Available at: https://www.ato.gov.au/General/Property/Residential-rental-properties/Expenses-you-can-claim/.

• Unknown (2018). 2018 Russell Investments/ASX Long Term Investing Report. [online] Asx.com.au. Available at: https://www.asx.com.au/documents/research/russell-asx-long-term-investing-report-2018.pdf.

• Unknown and Bonds Australian Government bonds Corporate bonds Debentures (2019). Property investment. [online] Moneysmart.gov.au. Available at: https://www.moneysmart.gov.au/investing/property.