- All

- Accounting

- Audit & Assurance

- blog

- Business Affiliates

- Business Partners & CSR

- Consultancy

- Contact Us

- Content

- COVID-19

- Environmental Awareness Series

- Events

- HTML Emails

- Investing

- Miscellaneous

- News

- Seminar

- Services

- SMSF

- Tax

- Tax & Accounting

- Uncategorised

- Uncategorized

- Visa News

- We are

- Wellbeing Series

- You are

Investing in Australia’s Property Market

The Australian property market has always held great appeal to both domestic and foreign investors. With a relatively stable economy and continued demand for housing, the Australian market provides ideal conditions for a greater return on your investment.

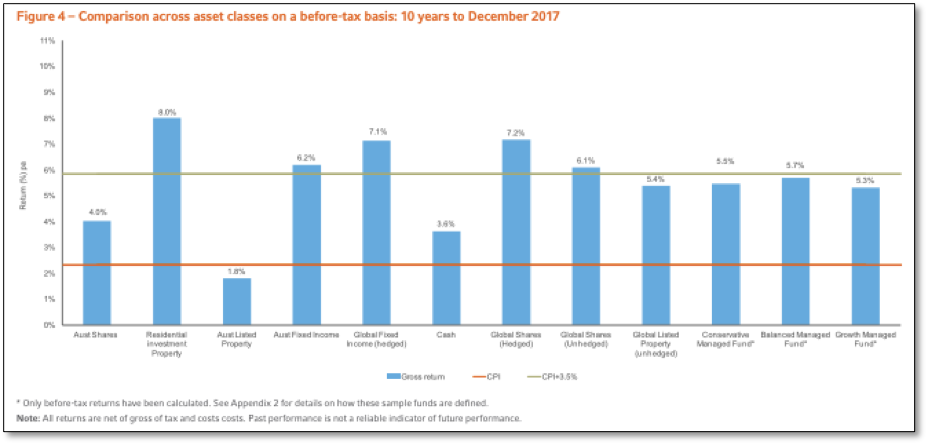

As can be seen in the ‘2018 Russell Investments/Australian Stock Exchange (ASX) Long Term Investing Report’s’ graph below; as of December 2017, Australian residential property gave an average gross (before tax) return rate of 8% over the last 10 years followed closely by the ‘Global Shares’ market at an average annual return on investment at 7.2%.

10-Year Average of Return On Investment by Asset Class:

Annual Charity Golf Day 2019

A great day was had by all at the Annual Walker Wayland NSW Sydney Charity Golf Day on Thursday, 21 March at The Moore…

All you need to know about Electronic Signatures…

We are all familiar with the purpose of a signature however with the constant development of technology observed over the past few years – things have dramatically advanced.

We have experienced a shift away from hard copy and physical documents sent with ‘snail mail’, toward electronic documents shared via email, cloud-based software and online sharing services.

But the ease of electronic document usage presented us with a unique problem – how do we get the recipient to sign it?

Don’t fear however, as you may or may not be aware, there is now the ability to use electronic and digital signatures to avoid any issues and keep the document in soft copy form.

In fact, the E-Signature sector is booming – now on track to be worth an excess of $5 billion by the decades end according to DocuSign CMO Dustin Grosse (1)

Despite its growing popularity and use – the concept can be confusing and complex to understand so here is what you need to know.

1 June will see Upcoming Changes to ATO Online Terms & Conditions

Updates to the ATO Online Terms & Conditions will see changes including: The ability to authorise your tax or BAS agent to designate their…

New Visa Subclass Announced: Five-year sponsored parent visa subclass 870

The new sponsored Parent Visa Subclass 870 will allow Australian Citizens and some Permanent residents to be able to bring over a parent to live in Australia for up to 5 years and will be far more advantageous over previous subclasses offered.

What do the changes include?

It was announced that from 17 April 2019 applications to sponsor parents for either 3 years or 5 years under the new subclass 870 will be open. Visa applications will be open from 1 July 2019.

- The Government has announced that 15,000 visas in this category will be granted in each program year.

- There is no “balance of family” test for this visa as it provides for temporary entry of biological or step-parents.

- The sponsors must be Australian Citizens or Permanent Residents who are usually resident in Australia for four years.

Analysis & Comment:

This new subclass of visa been highly anticipated and it likely to prove popular with many Australian permanent residents and citizens who wish to bring out a parent for an extended period of time. The huge advantage of this visa over the other parent visa sub-categories is that the “balance of family” test will not apply. That will open the market to many more people who are now able to sponsor their parent to Australia.

Financial capability for the sponsor will be a necessary requirement to demonstrate that the sponsor is able to support the parent or parents in Australia for an extended period of time. This is particularly the case as the visa holders will not be granted work rights and will have to maintain health insurance while they are in Australia.

Government Assistance For Farms Doing It Tough

Since release, consistent extension and alterations throughout the first quarter of 2019 have been added to this package, now valued at over $1.1 billion with various beneficial Financial and Taxation assistance. If you have direct connection, or have affiliation with drought-affected taxpayers, it’s important in this current ambiguous climate to be aware of any financial assistance made available to taxpayers by the Australian Tax Office (ATO) to aid in the process of drought recovery affecting on-going rural businesses.

Federal Budget 2019-20

“Tonight, I announce that the Budget is back in the black, and Australia is back on track…paying its own way.”

“Australia is stronger than when we came to Government six years ago. Growth is higher. Unemployment is lower. There are fewer people on welfare. There are a record number of Australians with a job. School and hospital funding are at record levels.”

“So, tonight, I am pleased to announce a Budget surplus of $7.1 billion” (albeit a forecast surplus for 2019-20) …”a $55-billion turnaround on the deficit we inherited six years ago” … and “A total of $45 billion of surpluses over the next four years.”

So said Treasurer Josh Frydenberg, as he handed down his first Federal Budget on 2 April 2019, a Budget he said intended to focus on restoring the nation’s finances, create new jobs with a strong skills and infrastructure agenda, and guarantee schools, hospitals and aged care. And, as he frequently emphasised “all done without increasing taxes”.

Single Touch Payroll for Micro or Small Employers

Background

STP, also known as ‘pay day reporting’, transmits employee tax and super information to the Australia Taxation Office (ATO) directly or through third party software providers after each pay run. STP reporting commenced on 1 July 2018 for employers with 20 or more employees, and there are around 45,000 businesses currently doing STP reporting under this regime.

Walker Wayland WA, WWNSW’s partner firm in Perth, sponsors The Tackling Suicide 2019 Charity AFL match

March 9th saw the excellent organisation Out of the Locker Room (OTLR) hold the Tackling Suicide 2019 Charity AFL match in Perth with Lifeline…

How can technology integrations improve my bottom line?

With the emergence of new technology every year it’s important for businesses of every size to adopt it as an integral part of their strategy and budget. Integrations between business processes and technology is no longer a luxury but a requirement to stay ahead of the curve and beat competition to have the most lean and efficient processes to increase that bottom line revenue.

According to a research piece by Gartner, organisations are facing immense competition on a local and global scale. To remain competitive and improve their bottom line, businesses are urged to turn to process improvement through ‘Business Process Management’ Automation (BPM).